News

Call for Applications: Guest Professor in Multinational Taxation at ICHEC

ICHEC Brussels Management School is seeking applications for the position of Guest Professor in Multinational Taxation (F/H/X) for the 2025-2026 academic year. This role is

Royal Decree on Structured Electronic Invoices

This Royal Decree, effective January 1, 2026, aims to implement the generalised obligation for taxpayers to issue structured electronic invoices, as introduced by the Law

SWISSHOLDING Meeting on E-Invoicing and International Tax Considerations

Source https://www.vatupdate.com/2025/07/07/swissholding-meeting–SWISSHOLDING

The Swiss Tax System

Main features of the Swiss tax systemFederal taxesCantonal and communal taxes Source Swiss Federal tax Authority

RELIVE THE MADNESS of the IHTF Beachside BBQ Bash

Beachside BBQ Bash! @Anemos in Knokke-Heist – ALL pictures released Around 250 Pictures available on: IHTF: Gallery – In-House Tax Forum TIP: select the first

Send us your questions on E-Invoicing implementation in Belgium

InHouse Tax Forum is gathering all questions on the implementation of the E-Invoicing mandate in Belgium on Jan 1, 2026. Their starting point is the

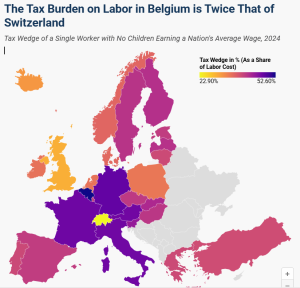

The Tax Burden on Labor in Belgium is Twice That of Switzerland

Overview of Belgium Recent Trends Source Tax Foundation

Comarch & Agfa-Gevaert Group: See How It Works in Practice

See how Agfa partnered with Comarch to implement e-invoicing in Italy and Portugal, optimizing business processes and complying with new B2B and B2G regulations. Comarch

🌟 IHTF R&D Event – it’s a wrap! 🌟

Yesterday was yet another important day for the exchange of ideas between Belgium’s leading tax teams and the government.The InHouse Tax Forum organized a successful

WTS Free Webinars: Navigating Expat Tax Regimes Across Europe

WTS Global invites you to a two-part webinar series exploring 𝐬𝐩𝐞𝐜𝐢𝐚𝐥 𝐭𝐚𝐱 𝐫𝐞𝐠𝐢𝐦𝐞𝐬 𝐟𝐨𝐫 𝐞𝐱𝐩𝐚𝐭𝐬 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞 — designed to help employers navigate opportunities, obligations,

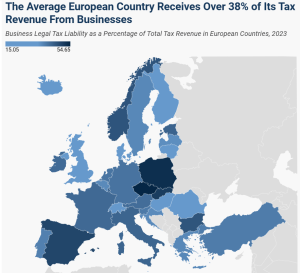

Businesses Pay and Remit 87 Percent of All Taxes Collected in Europe

Source Business Tax Revenue Contributions in Europe

Loctax webinar: From Complexity to Control: Streamlined Group Rationalisation

Register HERE Wednesday, April 23, 20252:00 PM – 3:00 PM GMT+2 Speakers Stevi Frooninckx CEO & Co-Founder at Loctax Kasparas Aleknavičius Growth Lead & Co-Founder at Loctax

Registrations are open for the 37th meeting of the iTx WG on May 9, 2025 @ Schreder in Liege

The 37th meeting of the iTx WG will take place on Friday May 9, 2025 at Schreder in Liege. Register here: https://inhousetaxforum.be/event/itx-working-group-meeting-on-may-9-2025-schreder-in-liege/ Agenda

Belgian Tax Administration Releases Draft Template for Domestic Minimum Top-Up Tax Return in Accordance with OECD Standards

The Federal Public Service for Finance has unveiled the draft template for the Belgian Domestic Minimum Top-Up Tax (DMTT). The tax authorities have designed this

Capital Gains Tax Rates in Europe, 2025

Source 2025 Capital Gains Tax Rates in Europe | Tax Foundation Europe

Invitation WTS: Africa in Europe Roadshow (April 11 in BXL)

The “Afri-Can-Do Tax” Roadshow, showcasing our ‘can do spirit,’ brings together tax experts from key regional hubs focused on or based in Africa to engage

Belgium E-Invoicing: Non-established entities may be exempt from the obligation to receive E-Invoices

In a recent series of discussions, stakeholders have addressed the complexities surrounding E-Invoicing obligations, particularly concerning non-established entities operating in Belgium. As outlined in the

Upcoming R&D Event Announcement

Dear IHTF Members, We are excited to announce an upcoming Research & Development event scheduled for May 15 in Brussels! This is a great opportunity for our

OECD published Consolidated Report on Amount B

In October 2021, the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (Inclusive Framework) agreed to simplify and streamline the application of the arm’s

36th meeting of the Indirect Tax WG @ P&G on Feb 21, 2025

On February 21, 2025, Procter & Gamble (P&G) hosted the 36th meeting of the Indirect Tax (iTx) Working Group, a significant event that brought together

Mr. Wesley De Visscher announced as Chief of Cabinet, Ministery of Finance

Words from Wesley: Today (Feb 7, 2025), I received a phone call that will stay with me for a long time. I get to start